If you’re bringing goods into the UK from overseas, then it’s fairly certain you’ll need to pay customs duty and VAT on their value. However, where your imports are from and what you plan to do with them could mean customs duty is reduced or, in some cases, removed altogether.

Here, we take a look at the duty relief schemes available to UK importers, and how you can use them to reduce your shipping costs.

What are Duty Relief Schemes?

Duty relief schemes are government initiatives that take a number of variables and trade agreements into account and avoid a ‘one size fits all’ approach to customs duty. You may be eligible for relief on taxation depending on where your goods are from, what they are and what you plan to do with them after their arrival in the UK.

The UK GSP Duty Relief Scheme

The most commonly-used scheme is the Generalised Scheme of Preferences (GSP) scheme. This is an EU directive retained by the UK that enables certain items from some countries to be imported at a reduced rate of customs duty, or sometimes at a zero rate. Typically this applies to many developing countries, giving them wider access to international markets and enabling them to trade more freely.

The UK GSP scheme has three clear frameworks:

-

Least Developed Countries Framework

This covers goods from ‘least developed’ countries (as classified by the United Nations) that have a free trade agreement with the EU. Goods from these countries (except for arms and ammunition) are free from import duty. The framework includes countries across Africa, Asia and the MIddle East, from Afghanistan to Liberia, Malawi, Zambia and more.

A full list is available on the government’s web page on trading with developing nations, but it’s possible to use group definitions for certain regional groupings of countries.

-

General Framework

This applies to countries the World Bank classifies as ‘low income’ or ‘lower-middle’ income. A full list is included on the same page linked to above, and includes countries such as Algeria, India, Syria and Vietnam. Imports from these countries will attract a reduced rate of customs duty.

-

Advanced Framework

This again is relevant to countries the World Bank classifies as low or lower-middle income, but with further qualifiers around their economic vulnerability, lack of integration into international trade and following UN conventions on human rights, etc. Import duty on goods from these countries is zero-rated.

The full UK Generalised Scheme of Preferences is available to download in OpenDocument format from the page linked to above.

How To Find Out if Duty Relief is Available

As well as where your goods are from, the level of duty will depend on what your goods are. First, you need to check your tariff code (also known as a commodity code or HS code) for the goods you are importing. (To find out more about tariff codes and how to find them, check out our simple guide on the subject, and also the official government guidance.)

The government’s Trade Tariff site gives a comprehensive list of all the categories and codes used by HMRC to determine the level of customs duty and VAT on your imports. Once you find the entry that covers your item, you’ll see tabs for further information: overview, import and export.

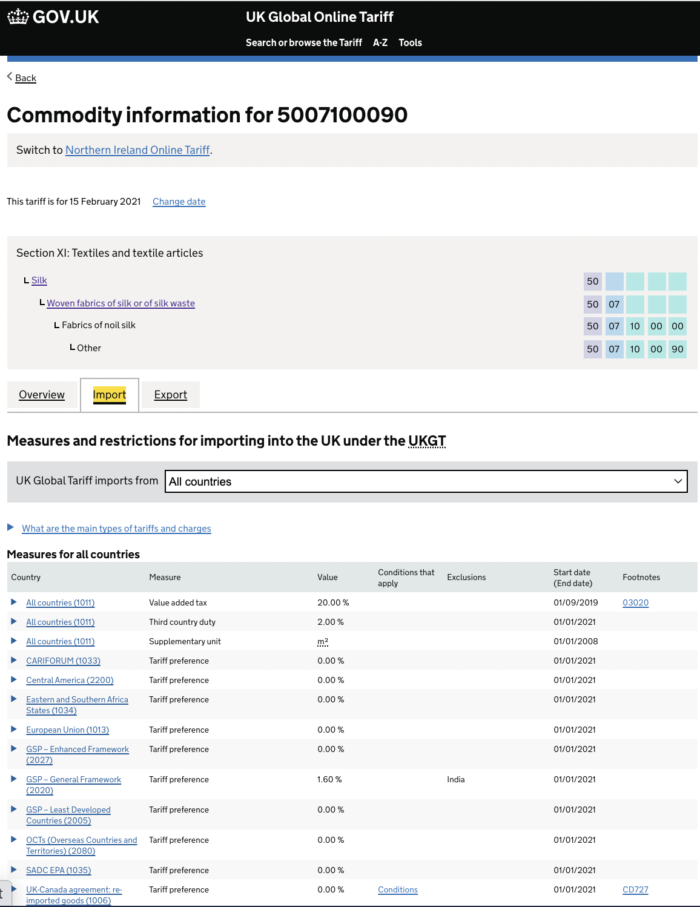

If you click on the ‘import’ tab, a complete run-down will appear of the applicable tariffs on the goods according to their country of origin. The example below shows the entries for a type of silk:

Tariff relief is technically referred to as ‘tariff preference’. In the example above, VAT applies in general but duty is zero-rated for several regional groupings of countries and reduced for those in the General Framework. India has been given a special exclusion.

How To Claim Customs Duty Relief

You can claim duty relief on products eligible under the UK GSP by providing an official proof of origin. The government’s site has a full guide on how to get proof of origin for your goods, but in brief, you will be most likely to need either:

- A completed General Scheme of Preferences form A. Copies are acceptable, so it doesn’t need to be stamped or signed by an authority in the country of origin.

Or:

- An invoice, consignment note or packing list with an origin declaration. This must include identifying information for the item(s).

If importing goods from within the EU or countries within the Pan-Euro-Mediterranean convention, you can also use the EUR1 or EUR-MED movement certificate to declare the country of origin.

It’s important to have your correct proof of origin in place when claiming duty relief. If HMRC decides to make an inspection and your goods have been incorrectly declared or are missing documentation, they are liable to be seized, delayed or even destroyed.

Preferential Rates Between The UK and EU

Following the UK-EU trade deal, duty relief is available on a number of goods imported from the European Union. The main condition for the tariff preference is that the products must originate from a country within the EU – in which case, if they fall under the right category or commodity code, they will be free of customs duty.

We have produced a complete guide to claiming preferential duty rates on goods imported from the EU (the link will open as a PDF). The important elements to bear in mind are:

Rules Of Origin

You must check that your imports meet the rules of origin. This is the ‘economic nationality’ of the goods, i.e. where they have been manufactured or produced, not simply where you have bought or shipped them from.

The government/HMRC have a full guide on checking the rules of origin. You can also check the UK Generalised Scheme of Preferences for the rules of origin for your goods, and see the preferences for the country you’re dealing by checking the product’s entry on the Trade Tariff site.

Proof Of Origin

There are two ways to declare the country of origin and therefore claim the tariff preference for goods imported from the EU.

- An origin declaration statement

This would be a section added to your invoice or consignment note stating that the exporter of these goods explicitly declares they are from the specified country of origin within the EU.

- Importer’s knowledge

Where an invoice or similar bearing a declaration is not available, you can claim using ‘importer’s knowledge’ if you possess supporting documents or records (often originating from the exporter) that your products are from a valid country.

If you are unable to verify the country of origin of your imports, then it may be wise to source a different supplier who will be able to provide you with the documentation you need.

Other Duty Relief Schemes

The above schemes briefly touch on the most common options for duty relief. But there are also a number of other circumstances that can be used to reduce your liability for customs duty. These mainly relate to how long your goods will remain in the UK, what you are using them for and where they will be stored.

- Temporary admission – this is when you are bringing items into the UK to use only for a short time, for a specific reason, before sending them back again.

- Inward processing – this can apply in cases when goods are imported from outside the EU to be processed, or used as parts in a resulting new product, and then exported.

- Outward processing – if you want to send your item(s) to another (non-EU) country to be processed or repaired and then bring them back to the UK, then you can claim duty relief.

- Customs bonded warehousing – this is a special procedure where your goods can be stored in a ‘customs warehouse’, where they will not be subject to duty or VAT until they leave and move into free circulation.

- Duty suspensions and tariff quotas for raw materials, parts and unfinished products – these are put in place to ease the import of certain goods into the UK, either to finish or use as materials in the manufacture of a subsequent product, if they are not available within the EU in sufficient quantities.

In Summary

In order to take advantage of duty relief or tariff preferences, you need to do the following:

- Obtain the commodity code (or tariff code) for your goods.

- Have proof of your products’ country of origin

- Check that your items comply with the rules of origin

- Ensure you possess all the appropriate supporting documentation

Help With Claiming Duty Relief

There are more details involved with tariff preferences than we can fully share here. Rules can vary according to the nature of your imports, where various parts are from, whether they are subject to further processing and if they will be scheduled for subsequent export.

With decades of experience in this field, our team is ready to offer expert guidance on claiming duty relief or reducing the cost of your shipments. Feel free to get in touch today.