What is customs clearance?

Customs clearance is a compulsory process for any goods entering or leaving a country. It requires the submission of various export and import documentation, as well as the payment of duties, VAT and any additional costs such as storage and testing by customs agents.

How long does customs clearance take?

Customs clearance is typically completed in minutes or hours, but it can extend to days or weeks if there is missing documentation or the goods needs to be inspected. In such cases the goods will be held until the necessary documentation has been provided or customs agents have completed their checks.

[cta url=”https://hemisphere-freight.com/contact/” text=”Let us take customs clearance off your hands” image=”https://www.hemisphere-freight.com/wp-content/uploads/2023/05/truck-customs-clearance-3064800_1920-1.jpg”]

How are customs charges calculated?

Customs charges are determined by the following:

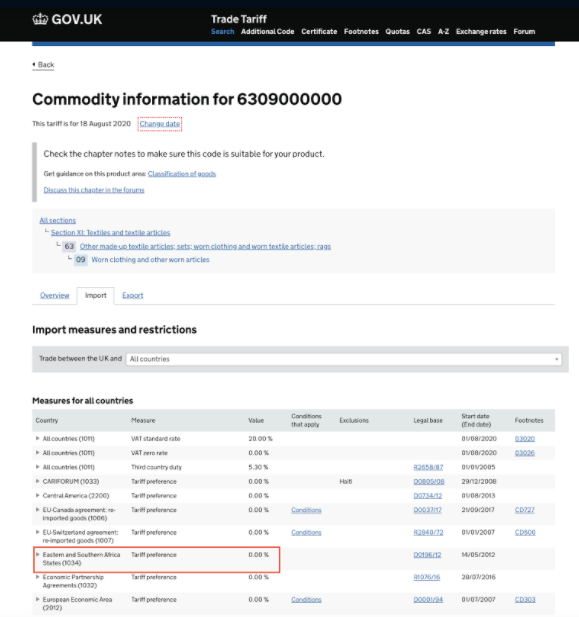

Duty – This is a tax levied by a country on all imported goods. It is charged as a percentage of a product’s value, as determined by its commodity code and associated duty rating. UK commodity codes can be found on the government’s Trade Tariff website.

VAT – This is generally charged on the amount paid for the goods, the shipping costs and the duty. Combined, this is known as the ‘taxable import’. The rate of VAT differs by country – it is currently set at 20% in the UK.

Additional costs – Customs charges also include any costs accrued as a result of goods being held by customs. Importers can be charged for any tests or X-Rays conducted to check whether a product is safe to enter the country and/or complies with trading or quality standards. They may also need to pay for storage should goods be held for longer than the allotted free-time period.

Anti-dumping duty – Certain products may be subject to anti-dumping duty. This duty is imposed by countries when they wish to protect the domestic manufacture of the product and in turn deter the import of it at a lower cost than the supplier’s native market rate. Importers can find out if their goods carry anti-dumping duty (and how much) through the Trade Tariff website. The UK government also regularly updates its list of applicable products.

How do you pay customs charges?

Most importers and exporters will have a freight forwarder or customs broker that pays customs charges on their behalf, saving them the trouble of paying it themselves. If the importer manages their own shipments, they’ll typically be sent an invoice detailing the charges once the goods arrive in the country. These will need to be paid before the goods are released for onward transport.

In certain circumstances, the importer won’t be liable for the payment of import charges. It will depend which incoterm has been agreed between the importer and supplier (exporter).

UK importers can also apply for a duty deferment account through HMRC, allowing them to delay payment of most customs charges. Depending on the required customs procedures, a freight forwarder or logistics partner can help manage the application process, or simply provide guidance on whether it’s worth applying for.

Can customs duties be claimed back?

Import duty can’t be claimed back, but VAT-registered businesses are able to claim VAT back on all of their imports. With VAT accounting for 20% of the entire process cost for UK importers, it makes for a considerable saving. HMRC provides further guidance on how to claim back VAT payments for imports.

Is it possible to avoid customs charges?

It is illegal to declare goods under lower commodity codes or falsely declare their worth in order to lower duties and taxes. However, there are various duty relief schemes available that allow importers to legally pay lower or in some cases no customs duty. Viability for a duty relief scheme depends on a number of variables including the type of product, intent for product’s use and the country of origin.

The main duty relief scheme available to UK importers is the EU’s GSP (Generalised Scheme of Preferences), which is set to become the UK GSP from 1 January 2021. The GSP allows goods purchased from suppliers in certain countries to be lower-rated or exempt from customs duty. It is designed to help businesses in developing countries trade globally.

The easiest way to find out whether you can claim an exemption is to check your commodity code through the Trade Tariff website. The relevant product page will detail any import measures and restrictions, including duty exemptions for certain countries.

There are a number of other duty relief schemes that provide exemptions based on how a product will be used and the length of time it will be in the destination country. These include:

- Temporary admission – for goods brought into the UK for designated, short-term use (e.g. an exhibition)

- Inward processing – for goods imported from outside the EU to be processed and then exported (either to outside or inside the EU)

- Outward processing – allows the export of goods to another (non-EU) country for processing and repairs, with full or partial duty relief when they return to the UK

- Bonded warehousing – customs warehouses allow goods to be stored duty and VAT free until they are ready for onward transport.

- Duty suspensions and tariff quotas – relief is available on products that are imported to finish or use as raw materials in the UK (if the goods or materials can’t be bought in sufficient quantities from within the EU).

What documentation is required for customs clearance?

The amount of documentation required for customs clearance will vary by country, but the following documents are required in the majority of countries:

Export Documentation

- Purchase order from the buyer

- Sales invoice

- Packing list

- Bill of lading or air waybill

- Certificate of origin

- Any other documentation as required by the buyer, or as outlined in a letter of credit from a financial institution

Import Documentation

- Purchase order

- Sales invoice from supplier

- Bill of lading or air waybill

- Packing list

- Certificate of origin

- All other documentation as required by the buyer or the terms of a letter of credit

Certain items will also require an import or export licence, which place limits on the amount of goods that can leave or enter a country over a certain period of time (typically a year). Licences are handed out by different government departments, depending on the nature of the goods.

Which items require a licence?

The majority of items don’t require an import or export licence. Those that do are often dangerous or require heavier regulation. They include but are not limited to:

- Firearms and ammunition

- Drugs

- Nuclear materials

- Steel and iron (from certain countries)

- Poultry, meat, milk and other foodstuffs

- Livestock

- Blood

- Fur

- Endangered Species

Customs clearance with HFS

Here at HFS, we offer a dedicated customs clearance service as part of our full range of logistics solutions, assisting with customs documentation and all other formalities to ensure the smooth transport of our customers’ goods. We also operate customs warehousing facilities at London Heathrow and Ipswich, close to the Port of Felixstowe and the major trunk roads of the A14 and A12.

Whether you’re seeking a long-term partner to look after your logistics and customs clearance, or require support for a one-off shipment, please don’t hesitate to get in touch to discuss your requirements.